The Definitive Guide to Hanna Properties

Wiki Article

Excitement About Hanna Properties

Table of ContentsNot known Facts About Hanna PropertiesThe Hanna Properties PDFs3 Easy Facts About Hanna Properties DescribedHanna Properties for BeginnersThe Only Guide to Hanna Properties

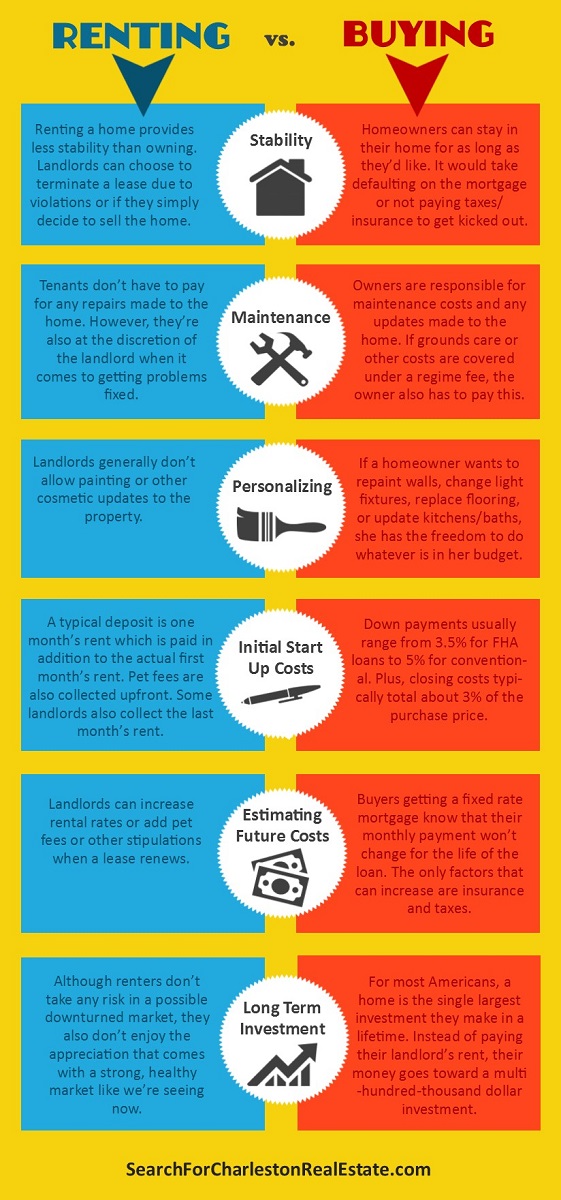

Residence living provides even more personal privacy and area, however apartment or condos may have a lot more features. Select which categories interest you and see where you can discover your brand-new home today.Allow's cover the advantages and negative aspects of renting out versus purchasing a residence, so you can find out what jobs best for your financial resources, way of living, and future plans. When renting a home, you're just responsible for paying your month-to-month rent and any type of utilities that aren't included. You're out the hook for common homeowner-related costs, such as building taxes, home maintenance, or fixings.

Buying a home includes an entire number of in advance costs that you won't have to pay for a rental. Some rental residential properties have no ahead of time prices at all. At a lot of, you might have to pay an application cost and/or a safety and security deposit before you relocate. Application fees vary from state to state but are typically less than $50.

The Definitive Guide for Hanna Properties

Look very closely at your rental contract or lease to recognize the notice duration, or just how much time in advance your property manager should inform you, ought to they pick not to renew your lease or plan to vacate occupants. Rental fee increases Landlords usually raise rates to keep speed with rental costs and demand in the location or to counter rising cost of living.

In 2019, 78% of renters (https://www.goodreads.com/user/show/172256452-david-hughes) reported a rental fee increase and over half stated it affected their decisions to relocate. Renting might leave you with little space for upgrades to your room. A lot of property owners do not enable or will certainly require approval for modifications, such as paint walls or also hanging artwork.

8 Easy Facts About Hanna Properties Shown

When it boils down to it, the greatest disadvantage of renting out is that you're paying money that goes directly into your landlord's pocket. Even if they need to pay a home loan on the home, they are still earning home equity as they pay down the financing principal and the property values in worth.Leasing, on the other hand, doesn't featured that very same level of safety and security; you may have to suddenly find a brand-new home in a brand-new place if your property owner chooses to sell (park ave rochester apartments). According to a research by Improvement, it takes approximately 4 years to recover the in advance expense of buying

If you have a fixed-rate mortgage, you'll likewise have satisfaction that your settlements will not increase every yearunlike leasing a home where you may see annual lease boosts. While your home's property tax obligations and insurance might change, your principal and interest will remain the exact same for the full regard to your home financing.

Not known Facts About Hanna Properties

If something breaks, it's up to you to repair it or to hire someone who can do the task for youfor an expense, obviously. Once you purchase a home, you're rooted to that home's area. If you obtain an offer for your desire work in another state or determine to move in with a better half, it can be more challenging to make that step if you need to first market your home or convert it to a rental home.

In this instance, a $200,000 home would call for as little as a $6,000 down repayment. Keep in mind: While down repayment needs are a lot less strict than they utilized to be, you will have to pay for private mortgage insurance (PMI) if you place anything much less than 20% down.

Hanna Properties for Beginners

Are you thinking of renting a home in New York City? It makes sense if you're aiming to upgrade from an apartment in order to get more area - https://www.provenexpert.com/hanna-properties/?mode=preview. It's likewise a great alternative if you wish to test out what it's like to keep a house before getting one below or in the suburbsExtra privacy and outside area are 2 major benefits of leasing a home in NYC, claims Kunal Khemlani, a broker find more information at Corcoran. This may be a patio area, terrace, or perhaps a backyard. But that exterior space means doing your own backyard job. (More about that later on!)Another perk is that you might get your private vehicle parking, he claims.

Report this wiki page